Vietnam’s economy is one of the fastest growing in Asia — and given the current state of trade in the region, the country is well positioned to continue the expansion of its $200B GDP through export growth. According to Bloomberg, Vietnam already ranks third worldwide for the best-performing market with plenty of additional upsides and the promise of more foreign investment to come.

New Investments in a New Market

The Southeast Asian country, which was amazingly only opened to foreign investment in 1986, is seeing capital investment in many areas such as electronics and textiles. The country’s low costs, an abundance of labor, and clear permitting processes make it an attractive place to invest. Vietnam’s labor force is young and willing to work for low wages. The country’s growth, however, has helped the country lower its poverty rate and get more people working.

Foreign direct investment (FDI) continues to increase with the primary beneficiary being factories making goods for export. Most investment is coming from South Korea, Japan, and Singapore, where it costs more to manufacture goods than in Vietnam.

Dustin Daugherty, senior associate in business intelligence with the Vietnamese company Dezan, Shira & Associates states, “The FDI scene in the economy continues to thrive. While a lot of attention is paid to big-name deals, the number of small to medium-sized enterprises and smaller multinational company investors continues to tick up, and enthusiasm is high.” Mr. Daugherty does not believe that Vietnam has reached its full growth potential yet.

Economic Growth in Vietnam

All eyes are on Vietnam as the country’s economic reforms have improved the country’s financial outlook. Last year was the turnaround year for the country. Vietnamese economist Le Xuan Nghia states: “Last year Vietnam’s GDP achieved a 10-year high growth rate which is expected to continue this year. The growth was attributed to the increase of consumption and exports, which was far above the set target. Domestic enterprises reported a higher export growth than that of foreign companies. Vietnam gained a high record of $40B from agricultural, forestry, and aquatic exports.”

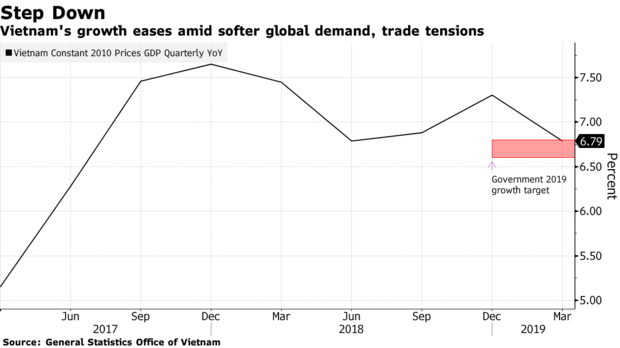

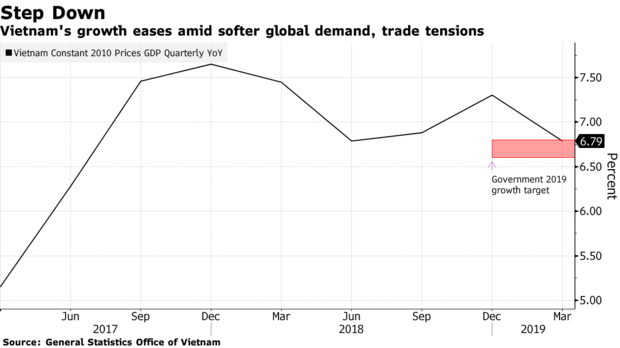

Despite a small dip in growth in the second half of 2018, the economy is doing well in 2019 with a favorable outlook for the rest of the year.

After being down the first two months of 2019, exports rebounded in March, led primarily by electronics. Exports overall increased by almost 5 percent in the first quarter of 2019 as compared to the year prior.

In April 2019, industrial production growth rose as exports grew substantially as compared to the year before and retail sales increased. For the first four months of this year, FDI was also up, partially because of firms moving away from China.

Truong Van Phuoc, acting Chairman of the National Financial Supervisory Committee, said, “We hope Vietnam’s GDP will grow 7% and inflation is kept below 4% based on evaluating the world and domestic economic situations. Though the world economy remains unstable due to the ongoing trade war, there are still outstanding opportunities. The domestic economy is supported by policies to boost the private economic sector, reforms in the growth model, and improvements in the business environment.”

Meanwhile, policymakers in the country are discussing eliminating restrictions on foreign ownership within the country by the end of the year. The government realizes that it needs to further open its economy to sustain this growth and welcome new investors. Vietnam is still considered a frontier market but may be upgraded to a secondary emerging market later this year.

As trade tensions between the U.S. and China continue to mount, Vietnam will receive more foreign direct investment as an alternative manufacturing location. It’s a country that supply chain decision-makers everywhere should be watching very closely.