Shippers are happy about the impending launch of three new initiatives. These are in the wake of an investigation by the Federal Maritime Commission (FMC) into ocean carriers. The three new initiatives are the International Ocean Shipping Supply Chain Program, the reintroduction of the Rapid Response Team, and the designation of an FMC Compliance Officer.

Click to Read: FMC launches new initiatives to help shippers with supply chain challenges

Brace yourselves. With most COVID restrictions in China—Shanghai specifically—lifted, terminals are preparing for waves of imports hitting already congested ports. One estimate calculates an unshipped backlog of 260,000 teu from Shanghai for April alone. This means ports are scrambling to get ready for two months of backlog while also preparing for the peak summer season. For now, there are no major disruptions, and the feared tsunami hasn’t happened.

Click to Read: Terminals around the world brace as Shanghai exhales

It’s been a tough and expensive few years for shippers. Ongoing vessel delays have forced shippers to maintain higher inventory levels, leading to financial losses of about $10 billion over the course of the pandemic. At the same time, carriers—whose rates to shippers have skyrocketed—have made more than $163 billion in operating profit this year alone. For shippers, this has to cause some resentment, especially since that $10 billion doesn’t include losses due to delays due to missed connections and or long wait times in port.

Click to Read: Vessel delays costing shippers billions: Sea-Intelligence

The economy may be struggling, but America’s ports continue to maintain the historically high numbers we’ve had for the past few years. Specific mentions go to the Port of Long Beach, which in May had its second busiest month ever, and the Port of Charleston, which had its third-highest month ever. Although queue wait times have dropped, ports are still working through their backlogs.

Click to Read: Boom times not over yet: US container ports still near highs

With just over two weeks remaining before the longshore union contract for the U.S. West Coast ports expires, both sides felt compelled to break their self-imposed silence to refute media reports that the ports were preparing for a possible strike or lockout. Without offering any specific details, the International Longshore Warehouse Union and the Pacific Maritime Association both emphasized that the discussions are continuing and that no actions were imminent.

Click to Read: No Strike or Lockout Planned as West Coast Labor Contract Nears End

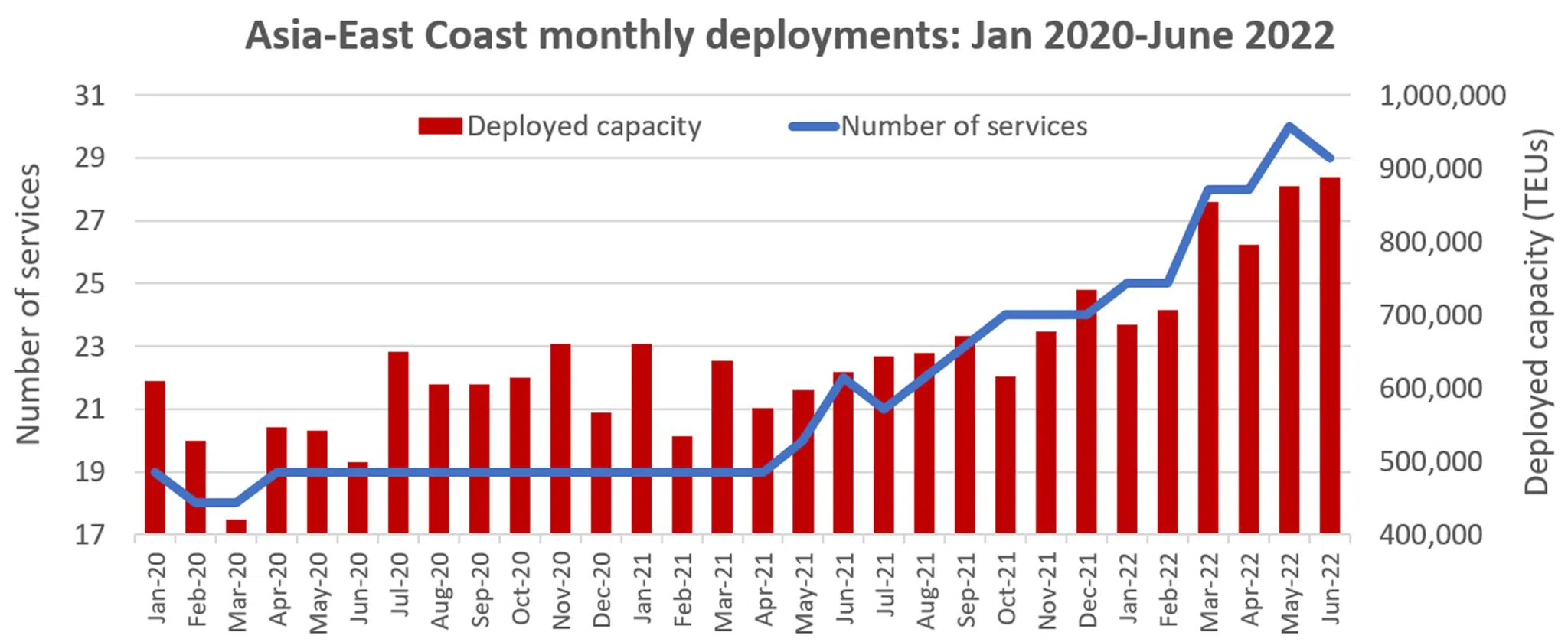

East Coast ports are starting to make the news—thanks to an overflow from the ports of Los Angeles and Long Beach to the west, as c

East Coast ports are starting to make the news—thanks to an overflow from the ports of Los Angeles and Long Beach to the west, as c